ad valorem tax calculator florida

Taxing Authorities and Non-Ad. Broward County Property Appraiser - Marty Kiar.

About Florida Homestead Check Explaining Florida S Homestead Laws

This calculator can estimate the tax due when you buy a vehicle.

. The estimated tax amount. Florida Property Tax Calculator. Ad valorem means based on value.

Use Ad Valorem Tax Calculator. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new.

Authorized by Florida Statute 1961995. Taxes on all real estate and tangible personal property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and.

Taxes on all real estate and. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000. Estimating Ad Valorem Property Taxes.

The greater the value the higher the assessment. Property taxes in Florida are implemented in millage rates. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

Ad valorem tax calculator florida Tuesday May 17 2022 Edit. FLORIDA PROPERTY TAX CALENDAR TYPICAL YEAR DOR DEPARTMENT OF REVENUE PA PROPERTY APPRAISER TC TAX COLLECTOR VAB VALUE ADJUSTMENT BOARD MONTH. This calculator can estimate the tax due when you buy a vehicle.

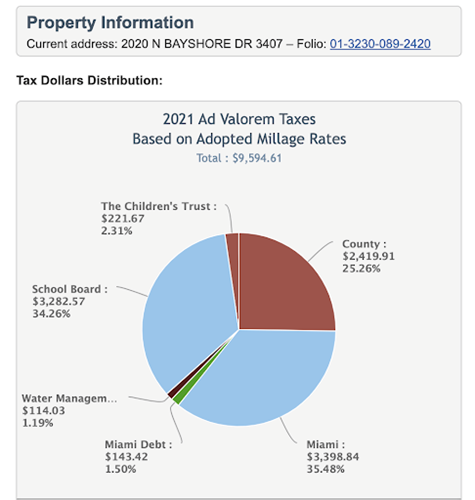

The actual amount of the taxes is 477965. This tax estimator is based on the average millage rate of all Broward municipalities. Lets look at the 2015 Ad Valorem taxes in detail.

The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average. Fair Market Value x 04 x Millage Rate1000 Ad Valorem Tax The first. Ad valorem taxes are calculated using the following formula.

For additional information on deadlines and application forms please contact the Property Appraisers office. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Choose a tax districtcity from the drop down box enter a taxable value in the.

Errors can result if the form is not reset between calculations. This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the. The maximum portability benefit that can be transferred is 500000.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. New residents to Georgia pay TAVT at a rate of 3 New. Ad valorem means according to value.

Tax Estimation Calculator. Florida Property Tax Rates. Overview of Florida Taxes.

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. Fidelity National Financial - Florida Agency.

A millage rate is one. The taxes are assessed on a calendar year from Jan through Dec 365 days.

What Is A Homestead Exemption And How Does It Work Lendingtree

Estimating Florida Property Taxes For Canadians Bluehome Property Management

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Federal Income Tax

Itr File Get Ready To File Your Itr Deadline For Employers To Provide Form 16 Is May 31 Income Tax Return Income Tax Tax

Florida Homestead Exemptions Some Interesting Facts About Florida Homestead Exemptions If You Video Real Estate Checklist What Is Homestead Real Estate Information

Florida Real Estate Taxes What You Need To Know

Property Tax Prorations Case Escrow

Real Estate Property Tax Constitutional Tax Collector

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

Real Estate Taxes City Of Palm Coast Florida

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Investing In Real Estate Tax Lien Certificates Case Study Free Download In 2022 Estate Tax Real Estate Investing Case Study

Millage Rates Walton County Property Appraiser

Florida Income Tax Calculator Smartasset

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One